Gnome-o-gram: Mortgage Bailout, Roman Style

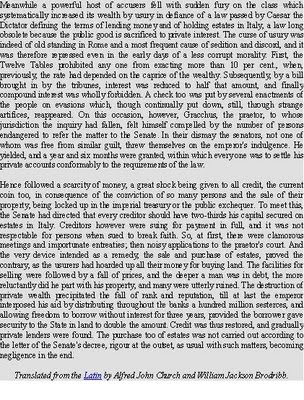

There is but scant innovation in human folly. Every generation convinces itself that it's living in a “new era”, where “all the rules have changed”, and consequently stumbles into the same potholes which swallowed countless ancestors. Knowing some history (rare today) and paying serious attention to its lessons (rare in any age) is an excellent way to avoid all-too-predictable calamities. Take the current woes in the credit markets, triggered in part by government meddling in the mortgage market. Certainly, this must be an unforeseen consequence of our twenty-first century fibre-optic globally connected financial system, with computer-modeled financial derivatives, risk management strategies, and all the rest of the hooey cooked up by all those bright fellows on Wall Street—how could they have possibly anticipated the mess they were getting us into? Well, by reading Tacitus, for one thing. In Book VI of The Annals, Tacitus describes how runaway mortgage lending, combined with government meddling with interest rates and loan terms resulted in a credit crunch and an eventual collapse in real estate prices. All of this happened in A.D. 32 during the reign of the Roman Emperor Tiberius.

Note that even “evasions” and “strange artifices” (credit default swaps, anybody?) played their part when this whole sordid mess blew up more than twenty centuries ago, and also that the form of the “bailout”—injecting liquidity into the banking system—employed by Emperor Tiberius was precisely the same as that cobbled together by the geniuses in charge of things today.

2 comments:

You read some weird stuff.

Real estate market news from the Roman Empire circa 32 A.D.

Really?

It just proves that this has all happened before.....I didn't really seek it out but I get these bulletins from an ancient civilization discovery site.....

Post a Comment